Economic Quarantine is different from great depression and great recession

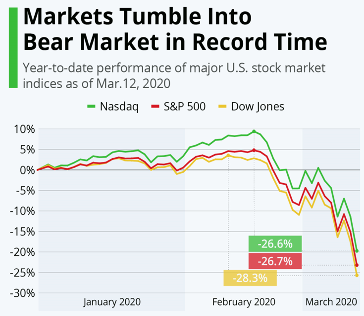

The economy was doing very well just two months back. There was euphoria in the market. Came the COVID-19 at the beginning of 2020 (in fact much earlier than this). The precipitous decline and record volatility in capital market reconfirmed its arrival.

The economy was doing very well just two months back. There was euphoria in the market. Came the COVID-19 at the beginning of 2020 (in fact much earlier than this). The precipitous decline and record volatility in capital market reconfirmed its arrival.

Fear not COVID 19 infected Economic Quarantine but act now before it’s too late

Euphoria turned into market capitulation in such a short time that investors started looking for safe heaven and started making an investment in US Treasury Bonds which turned yield on such bonds to fall to a historic low.

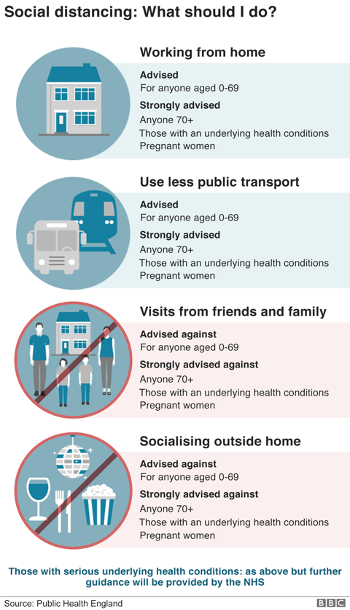

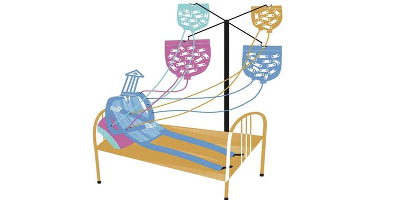

As a response to COVID-19 As a response to COVID-19 outbreak we adopted social-distancing (in fact physical distancing) which has halted and frozen economic activities- a situation of Economic Quarantine. What we need to understand that slowdown in global economic activity is not due to underlying economic issues but because of outbreak of COVID-19 – a health crisis. Also it is not comparable with the Great Depression of 1930s and the Great Recession of 2008. Both crises were due to demand shock. The current one is different. It is a supply shock due to Economic Quarantine. The COVID-19 caused sudden contraction of output, which in turn caused a loss of confidence. The demand shock which followed is the indirect impact of loss of confidence and output.

👉 Suggestions like increasing tax rates of high income tax payers are fraught with risk and if implemented it would be counterproductive.

👉 In fact we need more such persons to bring much needed equity capital in the economy. Taxing them high is archive concept and should be outrightly rejected.

The most important point about this crisis is that it is not destroying all economic activities or adversely affecting to all. In fact while creating losers it has also created winners. The understanding that the current situation is different from the past crises would help in designing and implementing right policies. The fiscal and monetary policies were sufficient to tide over the problems in the past. It took then around four years for normal level of recovery. Forget about waiting for four years we can’t afford to allow this situation for even six months. Therefore we need social involvement.

Any further delay in action on economic front can lead to virus getting into the financial system and the early signs of which are visible. This would cause serious structural damage to the economy. The impact of COVID-19 on the economy has so far been devastating. The world has never seen such contraction in the economic activity in such a short period of time. Epidemiologist are forecasting months / years of continuance of COVID-19 or at least till the time a vaccine is developed. It’s time to introspect. Stock markets can always bounce back but lost businesses probably would never. We need to save them – for the nation.

Any further delay in action on economic front can lead to virus getting into the financial system and the early signs of which are visible. This would cause serious structural damage to the economy. The impact of COVID-19 on the economy has so far been devastating. The world has never seen such contraction in the economic activity in such a short period of time. Epidemiologist are forecasting months / years of continuance of COVID-19 or at least till the time a vaccine is developed. It’s time to introspect. Stock markets can always bounce back but lost businesses probably would never. We need to save them – for the nation.

What would be the shape of recovery is significantly uncertain at this stage but V- shape is empirically the clear winner if one looks back data of 100 years. This can be an optimistic situation where sharp decline would be followed by quick recovery. The ugly cousin of V-shape is the U-shape where recovery would be delayed and there would be some structural damage to the economy. Most likely scenario in case of India assuming no return of virus. There are people who are advocating W-shape of recovery- which is sharp decline, a recovery, followed by second decline and then sharp recovery. But this believe is based on the assumption that only fraction of economy would be open and virus would come back again. The confidence in the statement suggests certainty and this is only possible if someone knows that virus is not going to die but would resurface again which will be followed by lockdown. This is also one of the scenarios but we need more evidence for the same and at this stage it appears too speculative. the L- shape of recovery (a permanent structural damage to the large part of the economy) is not envisaged even by pessimists.

We should understand that the shape of recovery would depend upon getting out of economic quarantine situation because the decline did not start with the economic issues. We therefore as a nation has to call what shape we want. So far we have done well in containing it and now we have India based data about it. If we act quickly on economic front we can shape the shape of recovery.

It seems chances of V- shape is vanishing with every continuing day of the lockdown. If we can restrict to U shape it would be better considering the scale of the problem. Some damages are bound to happen in certain sector of the economy. While making the decision we need to understand that by social distancing we are trying to avoid one heath crisis but economic quarantine is likely to create another health crisis of bigger order which is ‘DIP’ (despair, impoverishment and unemployment). No amount of fund availability will revive the economy if structural damage is done. Not only we have to improve demand but also provide supports to sectors in losers category. Without waving away COVID-19 concerns we need to address now on economic issues.

It seems chances of V- shape is vanishing with every continuing day of the lockdown. If we can restrict to U shape it would be better considering the scale of the problem. Some damages are bound to happen in certain sector of the economy. While making the decision we need to understand that by social distancing we are trying to avoid one heath crisis but economic quarantine is likely to create another health crisis of bigger order which is ‘DIP’ (despair, impoverishment and unemployment). No amount of fund availability will revive the economy if structural damage is done. Not only we have to improve demand but also provide supports to sectors in losers category. Without waving away COVID-19 concerns we need to address now on economic issues.

If we do not act now then the impact on social behaviour and economic health would be calamitous and graver than the COVID -19 can do itself. Economy would need something to start and therefore actions on demand side as well as supply side should be done simultaneously. Under the current situation any delay in preparation of financial statements would delay financing either from banks or from alternative sources like private equity. Classifying auditing as an essential services like banking services would help greatly in this respect if lockdown is lengthened. Impact analysis of each sector of the economy is very important under various time frame of lockdown. Rising household debt and loss of confidence of consumers are the cause of concern. Numerically household debt to GDP in India has risen but it is still way below in comparison of large size economies. However. We would be missing a point if we don’t consider per capita income which is very low.

Therefore any further delay in removing restrictions will cause serious behavioural changes which in turn will delay recovery. Finding employment is the key as no amount of cash support would be sufficient to create sustainable demand. The limitation of government on this account is obvious. Efforts should be made to re-employ those who have lost jobs so that poverty and hopelessness can be avoided. If one looks at the data of infected and related mortality rate it seems Michael Levitt–a Noble prize winning biophysicist is right in concluding that overreaction to the disease could do more harm than the disease itself. The time has come to respond quickly on economic issues before it’s too late.

Author

Private: Rajiv Singh

Senior Strategic Advisor – Financial and Valuation

10 Suggested Action Points

1) Identify winners and losers by bifurcating the economy in sectors and geographies

2) Create a COVID-19 Economic Response Centre (CERC) for designing and monitoring of policies.

3) This should also resolve issues related to Start-ups.

4) Policy should be based on sector and geography. National policy would be inappropriate as the current situation is different from the past.

5) Bifurcate work force between WFH (work from home) and CWFH (can’t work from home). Make efforts to converts CWFH to WFH category with skill-top up program and identifying such opportunities in the world market, and winners category in India at least for a short to medium term.

6) Four parties should absorb losses- Government, Banks, RBI and the Society. Any efforts to address problem via bank would be counterproductive. Poor response of TLTRO v2.0 is an example. If we force PSBs to lend then there are chances of return of situation that prevailed before 2014.

7) Allow people to work with adequate safeguard at work place and keep on adding health infrastructure.

8) Attract global investors in manufacturing, research and designing (make a compressive policy for “design in India”) and create a dedicated centre.

9) Relax relevant restrictions and curbs under income tax and companies Act at least for two years and reduce compliances to the minimum.

10) Along with policies of economic wellbeing make an efforts towards physical wellbeing so that labour force is ready to produce